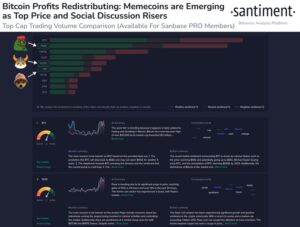

Projecting on-chain analysis service Santiment warns that the unanticipated revival in speculative meme coins such as PEPE, Floki, and WIF raises concerns about the larger cryptocurrency market prospects.

Along with the strong increase in non-fundamental dog cryptocurrencies, record Bitcoin ETF volume suggests that overly optimistic bulls may face painful pullbacks if trend halts.

Meme Coin Craze Returns with Bitcoin’s Above $59k Push.

Meme currency like PEPE and Wifedoge have gained significant traction with Bitcoin’s $59k surge, raising concerns about parallels.

“Meme coins have seen significant popularity and market value rise on a largely flat Tuesday,” the researchers said Tuesday, including PEPE up 63%, Floki up 44%, and WIF at 43% on the day despite minor swings everywhere.

According to Santiment’s research, during previous market cycles, substantial movement of capital from Bitcoin into highly volatile derivative products frequently marked major tipping points, making this week’s movements a ‘warning flag’ that should be properly monitored.

Record inflows from Bitcoin investment trusts.

Santiment further notes that the Grayscale Bitcoin Trust (GBTC) has posted successive all-time high daily withdrawals of more than $7.64 billion this week, showing that holders are hurriedly restarting holdings elsewhere. Similar dynamics plagued GBTC, resulting in prior bear movements.

If the idea is to rotate short-term gains into lagging small caps such as meme coins in the expectation of sparking a bull run, history shows that retail’s moves could backfire if Bitcoin sentiment shifts sour.

Thus, Santiment warns of disturbing indicators of excessive extension and greed in sectors such as meme tokens, as layers of barriers above look to oppose Bitcoin’s climb, suggesting a rapid mood shift if sustained buying dried up.

Release: The purpose of this content is only to provide knowledge. Readers have to do their own research before making investment decisions.